Should I Buy Whole Life Insurance?

Should I Buy Whole Life Insurance? I get asked this frequently. Maybe your financial “advisor” recommended it. So, should you buy whole life insurance? No.

Introduction

I work specifically with folks over fifty, and annuities are the primary poorly performing products pushed on my people. (I did a couple of episodes on these, starting with the question Should I Buy an Index Annuity? Those are Episodes 151 & 152.) But the next foolish financial product peddled to clients is the infamous whole life insurance policy. And this “payday lender of the middle class” is pushed on people of all ages.

If a financial services representative has never sold you a whole life insurance policy, good for you! This episode will further insulate you from a multi-thousand-dollar mistake. You may know others who bring it up or work with Mass Mutual, Northwestern Mutual, or one of the many other companies that produce and promulgate these monstrosities. I encourage you to send this episode to them.

If they have sold you a whole life policy, and perhaps someone sent you this, then you absolutely must read, watch, or listen. This information can save you tens of thousands of dollars.

Episode Flow

I am going to split this episode into two main parts.

First, I’m going to sell you a whole life insurance policy. That’s right. I will present to you the many pros and a few minor cons of the product and sell it to you like I was taught to sell it. By the end, you may just wonder why I’m so against it and be hunting for the nearest insurance office to get yourself one.

Then, I’m going to debunk the claims of whole-life sales professionals systematically and show you the many more cons that they gloss over or ignore altogether. By the end, you’ll never buy a whole life policy, and if you do have one, you’ll be looking for your insurance “advisor” to cancel it.

The Set-Up

For this first section, I will speak to you directly as if you were a client. Let’s assume a few things:

- You’re a twenty-five-year-old couple with a good income and have money to save.

- You’re working with me because I’m a Certified Financial Planner, and I’ve told you I’m a “fiduciary.”

- We’ve already covered several financial planning topics, such as:

- Emergency Funds and regular savings.

- Retirement Accounts, including 401(k) and IRAs, and the difference between Traditional Pre-Tax and Roth After-Tax accounts.

- Stock vs. bond mutual funds.

- Term life insurance to protect each other and your children.

A good sales professional will make this much more of a discussion than a monologue. But since you can’t respond, I’m going to rattle off the whole thing.

You Should Buy Whole Life Insurance – The Sales Pitch

Okay, Mr. and Mrs. Client, we have our emergency fund for the short term, our retirement accounts of 401(k) and Roth IRAs for the long term, and we’re saving 10% of our income for retirement. But what about the mid-term? We need one more piece to this comprehensive strategy. This piece needs to do four things:

- It must provide liquidity in the mid-term.

- It must provide safety against stock market risk.

- It must provide tax benefits.

- It should provide additional benefits to fill gaps or save money.

Of all the strategies and products out there, we’ve identified one that perfectly fits our holistic strategy: the “limited-pay whole life insurance policy.”

What do you know about whole life insurance?

Let’s set all that aside and start from scratch. There are some bad policies out there that give the product a bad name. But let’s not throw out the baby with the bath water. Let’s look at one of the good ones, and you’ll quickly see how it fits in an overall comprehensive strategy.

Whole Life Insurance Basics

Whole Life insurance has three components.

The first component is the premium. This is what you contribute or invest into the policy. All insurance has a premium, and many think of this as a bill or expense. But in the case of whole life, it’s not an expense; it’s an investment, not unlike a Roth IRA contribution. We’ll show premiums in red.

The second component is the death benefit. It is life insurance, so it has a death benefit. As we discussed, term life insurance gives you a death benefit for a term, and then it’s gone. But, as the name suggests, whole life insurance gives you coverage for, well, your whole life. We’ll show the death benefit in blue.

The third component is the cash value. This is what makes whole life insurance unique and makes it an amazing Swiss army knife for financial planning. It’s easiest if I show you how this works. We’ll show the cash value in green.

Let’s see how this works in action. We’ll show a policy with a $250 monthly investment on you, Mr. Client.

Whole Life Insurance Illustrated

Premium

First, we’ll see the premium accumulate. $250 per month equals $3,000 per year. With some permanent life insurance policies, this goes on forever. But we don’t want to still be investing in retirement. We want to be done funding your 401(k), your Roth IRA, and your whole life insurance by retirement. So the great part about this insurance is that you only contribute the premium until age 65. Then, the premium stops, and the policy is “paid up.”

Death Benefit

Next, we’ll see the death benefit. At your age, $250 per month equals about $250,000 of death benefit. You’ll immediately notice it’s much more “expensive” than term life insurance. Why is that?

What is the percent chance that you will die in the next twenty years? It’s very low. That’s why the twenty-year term insurance premium is low. It’s a game over numbers. They can sell enough policies to 25-year-olds that never pay out to cover the one that does.

What is the percent chance that you will die eventually? 100%. The term almost never pays out, so it’s cheap. Whole life insurance always pays out, so they factor that into the cost. How much do they need to charge on the insurance side of the premium so that they can invest that and be able to pay out the death benefit when, not if, it pays out?

Still, the increased cost of the death benefit is only part of the increase in premium over term insurance. This last part is the best.

Cash Value

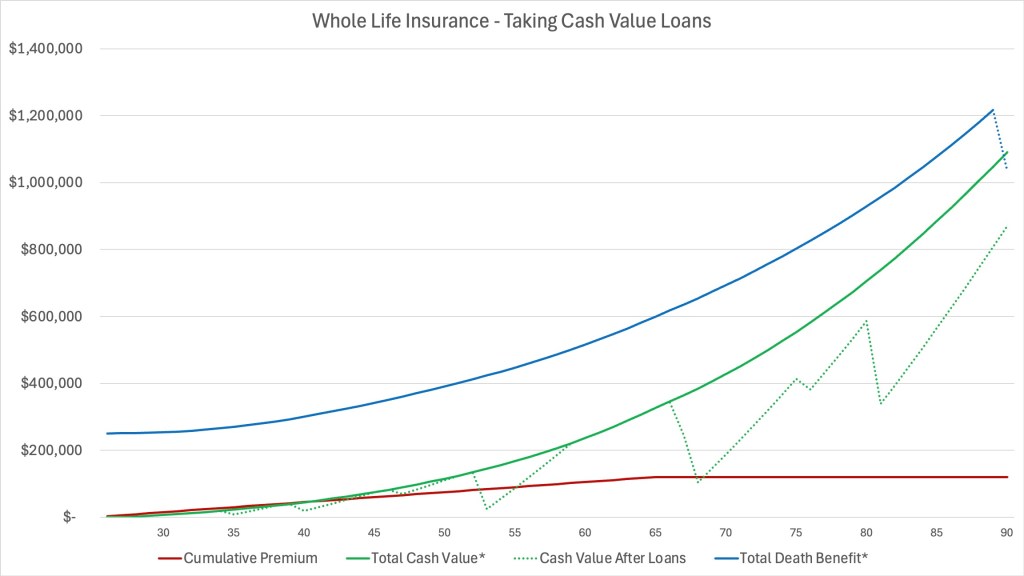

The last part of the policy is the cash value, which is like a savings account inside your policy. That cash value is going to grow inside the policy. In the first couple of years, more of the premium goes to the death benefit, but within the first years, the growth of that cash value picks up and begins out-pacing your premiums. At that point, your premiums effectively cease to be an expense and become an investment. That cash value keeps compounding, even when the premiums are done, all the way until death.

And because the cash value is compounding, the death benefit also grows to stay ahead of it. By the end of your natural life, both are well over $1,000,000.

Cash Value Benefits

Let’s take a closer look at five benefits of cash value.

- Guaranteed Growth. Your cash value will grow every year, guaranteed. Unlike the stock market, which can and will fluctuate and often lose 20-50% of its value, your cash value is guaranteed to grow every year! This is a great way to diversify your risk.

- Dividend Growth. We are recommending a mutual insurance company for this product, which is a company owned by its policyholders, not stockholders. In addition to the guaranteed growth, when the mutual company makes money, it pays dividends to you, the policyholder. The company is not guaranteed to make money, but it has paid a dividend every year for the last 90+ years. That’s a pretty great track record! These dividends are often around 5-6% and can be reinvested into the policy.

- Tax Deferred Growth. Your cash value grows tax-deferred, much like a retirement account. If you saved this money into CDs, Money Market accounts, or brokerage accounts, you’d be paying taxes every year, hampering the growth! What’s more, after a few years, we can reduce the amount growing taxably in our emergency fund because we have it covered in whole life!

- Tax-Free Use. You can use your cash value tax-free anytime, even when the growth exceeds your contribution. We do this through a loophole in the IRS tax code: policy loans. Instead of withdrawing the money, we take a loan against the policy with the cash value as collateral. Loans are always tax-free. And, because we aren’t actually taking cash value out, we still get guaranteed growth and dividends paid on that cash value. We can pay the loans back if we want or not! It’s completely up to you.

- Liquidity. In case you missed it, we can access this money at any time. It grows tax deferred and can be used tax-free like a Roth. But the problem with a Roth is that it’s locked up for 35 years. You can access cash-value funds at any time for any reason.

Cash Value Diversification

You’ve probably heard that the key to wealth-building is diversification. Diversify, diversify, diversify! Whole life insurance cash value is the ultimate diversifier. It diversifies in three ways:

- Risk Diversification. The guaranteed growth is a great way to diversify your investing risk. The market can go down, and even bonds can go down, as we saw in 2022. But Cash Value will always grow, guaranteed!

- Tax Diversification. Cash value’s tax-preferred status means we can diversify where we withdraw money and save on taxes. We stick it to the IRS and help you save more of your hard-earned money.

- Liquidity Diversification. We don’t want all our money stuck until retirement. You have a lot of life between now and then. Cash value gives us access throughout our lives and can also assist in retirement.

It’s the trifecta of diversification. Let’s see how we can use it in your comprehensive strategy.

Cash Value Strategies

Let’s get something clear first. Whole life is not a replacement for everything else. We still need the short-term liquidity of an emergency fund; but over time, we can have less in our low-interest savings as our faster-growing cash value will become our emergency fund. We still need our retirement account invested in equities for long-term growth. But there are two major strategies we can use cash-value whole-life for that will supercharge our holistic financial plan.

Mid-Term Major Purchases

You have a lot of life to live between now and retirement and many important expenses along the way. We don’t want all our money going toward something we can’t use for thirty years. By funding whole life insurance, we can use it to fund these major purchases:

- Vehicles

- Children’s Education

- Downpayment on a home or cabin

- Wedding

- Etc.

When, not if, you have these expenses, you simply borrow from your cash value and pay it back. Then, borrow again for the next one and pay it back.

Cash value is perfect for these expenses. We don’t want to borrow from the bank when we can borrow from ourselves, and we can’t touch our retirement accounts for these expenses without incurring taxes and penalties. And if we tried to use a brokerage account for them, not only would we pay taxes on the withdrawals, but you know that the stock market will be down precisely when you need the money.

Cash value is always there; it never loses value, and you can access it completely tax and penalty-free. It’s a great addition to the midlife plan. But wait, there’s more!

Retirement Income Supplement

Your cash value will be so large by the time you get to retirement that it will be a great supplement! By having cash value along the way, we don’t need to reallocate your retirement accounts out of the stock market into bonds ten to twenty years out, as most people recommend. We can keep it invested for maximum growth.

In retirement, you will have market losses. When, not if, you lose 20-50% of your retirement accounts, you don’t have to worry. You can pull money out of your cash value for retirement income while you wait for the stock market to recover. You’ll have over $300,000 in cash value in this policy alone. That’s a great buffer against bad markets.

The stock market has always recovered and gone on to new heights. When it does, you can always pull money out of the recovered funds to pay back your cash value. Or don’t! The choice is up to you. If you don’t pay it back while you’re alive, the death benefit will pay it back for you before paying out tax-free to your beneficiaries.

Whole Life Insurance Summary

Let’s recap quickly.

- You’ll contribute premiums only until age 65.

- You’ll have a permanent death benefit that pays out tax-free to loved ones.

- The rest of your premiums go to building cash value.

- The cash value has guaranteed growth and dividend growth.

- You can access that cash value anytime for any reason, before and after retirement.

- You can pay back the cash value to take or not. The choice is yours.

- Cash value gives us risk, liquidity, and tax diversification.

- It perfectly supplements your emergency fund, 401(k), and Roth IRAs.

I recommend we get the full match on your 401(k) first. Then we should get some Roth IRA going. Because we can easily increase Roth IRA contributions in the future, but premiums are harder to adjust, I recommend we put $250 per month each into whole-life policies and $250 per month each into Roth IRAs. Those numbers will increase over time so that you’re eventually funding the Roth IRAs more. But we need to cover your short and midterm before we focus too much on the long term.

Does that sound good to you? Let’s get the application going.

You Should Never Buy Whole Life – The Rebuttal

What do you think? Does that make you want to buy it? Probably not, because you know the other shoe is going to drop. But perhaps you’re thinking, “It doesn’t sound that bad to me.” Let’s explain why it’s a terrible product by addressing each of the major “pros” of the policy and illuminating the flaws that were glossed over.

Cash Value Has a Terrible Rate of Return

The primary selling point of a whole life insurance policy is the cash value. It is a “savings” plan or “investment” inside the policy. The selling point of all savings and investment plans is the rate of return. If your money is not working well for you, find a better place for it. Thus, whole life as a strategy should have great returns. But it doesn’t. The returns of a cash value policy are garbage.

Compared to What?

I saw that Cash Value Returns are terrible—but terrible compared to what?

Nearly everything. As you’ll see shortly, the negative short-term returns of the product put you so far behind that everything other than cash and zero-interest bank accounts will beat it in the first couple of decades. But let’s not compare mediocre to mediocre. Let’s compare it to the best. If you are working with a Financial Advisor, you want the best strategies, not adequate ones.

The best investment you can make is in ownership shares of the best businesses in the world. We want to own great companies—to invest in equities. I can already hear the objections coming. Don’t worry; we’ll get to those.

The Benchmark

We will compare whole-life cash value returns to the S&P 500 minus 1%. Let’s assume that the alternative to working with a financial representative selling you whole life insurance is working with a financial advisor who will manage your money for a 1% assets-under-management fee. And let’s assume they did nothing but invest you in the S&P 500. Thus, we will multiply your contributions and balance by whatever the S&P 500 did that year minus 1%.

Because we are examining a representative selling a whole life policy to a 25-year-old, we will need 65 years of data. So, we will take 65 years of S&P 500 returns ending 2023.

Short-Term Return

The return on cash value in the first couple of years is negative 80-95%. You will lose 80-95% of your “contributions” in the first two years. From a year-to-year contribution standpoint (how much of your contribution goes to increasing the cash value) on a good policy, your annual losses by year are:

-98%, -97%, -48%, -21%, -16%, -9%, -1%, +8%

Did you start making 8% per year on your money in year 8? No! That means that by year 8, your cash value went up 8% more than your contributions for that year. Your cumulative total return on all contributions by year is even worse!

-99%, -98%, -81%, -66%, -56%, -49%, -42%, -36%, -30%, -24%, -20%, -15%, -11%, -6%, -1%, +4%

By year 16, are we averaging 4% per year? No! That is our total return. It takes fifteen to seventeen years for a “good” policy to break even. And this includes the “non-guaranteed dividend growth.” If you look at the guaranteed growth of the policy, it takes thirty to thirty-five years to break even.

Short-Term Returns Comparison

Let’s compare these abysmal returns to equities. Insurance agents always object to me doing this. “You can’t compare a long-term growth strategy to a fixed income strategy. You must compare cash value to other fixed-income investments.”

I disagree for two reasons. First, we’re not looking at long-term growth (yet). We’re looking at short-term returns.

More importantly, cash value is a horrible short-term investment, too. Because of short-term volatility, fiduciary financial advisors typically don’t use equity investing for short-term expenses. The Great Financial Crisis caused the S&P 500 to lose as much as 57% of its value in 18 months (from September 2007 to March 2009). And we surely wouldn’t want the possibility of a 10-50% loss in the first couple of years of investing, right?

Well, if you’re willing to take a guaranteed 98% loss in the first two years of cash value “investing,” surely you’re willing to risk the possibility of a temporary decline.

How can a savings strategy that guarantees losses be considered a safe investment?

Let’s look at the charts.

Short-Term Returns: Cash Value vs. Equities

The chart below shows the Total Return % for the first twenty years. The average annual return of the S&P 500 was only 6.8% over this twenty-year period, well below the 10% average. I’m not cherry-picking great returns to try and prove a point. These sub-optimal returns are mostly due to the 1973-74 oil shock bear market, causing a 43% decline over two years. Other than this brief moment of total return equality, equities have handily beaten cash value over the short- to mid-term.

Look again at these charts and tell me which you’d rather have over the short term:

- “Safe” cash value that takes fifteen years to break even.

- “Risky” equities with positive total returns in 19 of 20 years ranging as high as 74% and an average total return of 35%.

Cash value is a horrible short-term investment. Equities, though not traditionally used for short-term expenses, would be a much better investment even in the short term.

Long-Term Returns: Cash Value vs. Equities

Cash value is an even worse investment in the mid to long term. Let’s look at cash value and death benefit projections over a lifetime again.

Now let’s compare that to an 8% annual return and the S&P 500 over the last 65 years (minus 1%, a 10.61% average annual return).

A few things to note:

- This includes every scary bear market in the last 65 years.

- Our investor would have hit 65 in 1998, right before the “flat decade” and the massive losses of 2001 and 2008.

- They would have “lost” $1.2 million in 2008 and $2.2 million in 2022.

- Their equity value at age 90 would be just over $12 million, fully ten times more than the $1.2 million in death benefit and eleven times more than the cash value.

Why would you want a dime going into cash value when it could be going into equities?

Cash Value Safety is Sub-Par

Another touted benefit of cash value is the safety. It’s a safe and stable investment to use at the right time. But how safe is it?

Guaranteed Losses

We already covered this, but you are guaranteed to lose 80-99% of your first two years of investment. You won’t recover from this loss for 15 years.

Compare that to the worst financial crisis we’ve seen in our lifetime: the Great Financial Crisis. It had a 57% peak-to-trough decline in the value of the S&P 500, and it took about 5 years to recover.

I don’t know about you, but I’ll take a 57% decline and a five-year recovery over a 90% decline and a fifteen-year recovery any day. And I know, that only happens once in whole life and can happen repeatedly in equities. But as we’ve seen, the amount of growth between those declines in equities is so large that it doesn’t matter.

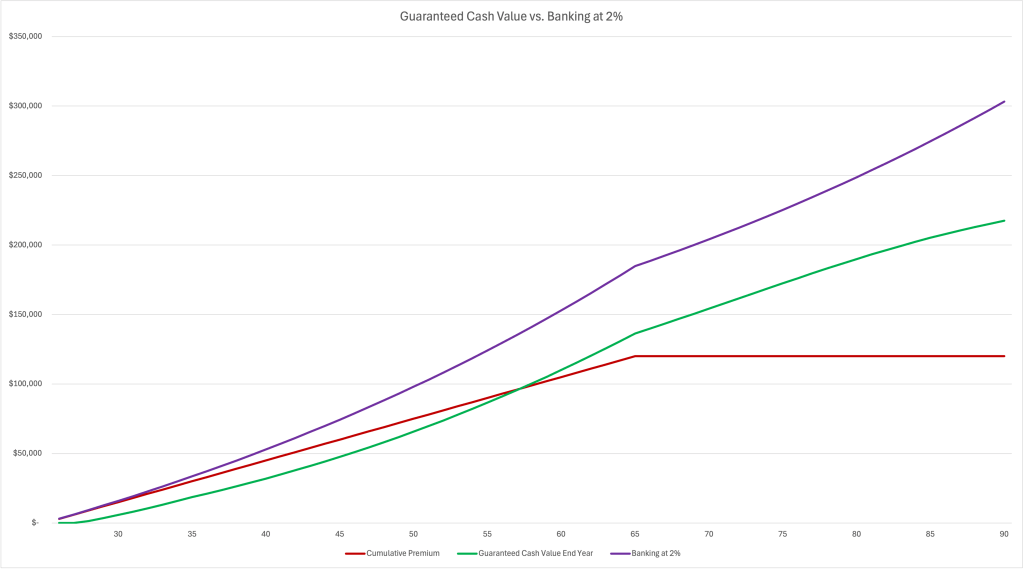

The Guaranteed Growth Sucks

Much is made about the guarantees of whole life, including that it is always guaranteed to grow. They then draw all your attention to the “non-guaranteed” values that include dividends. But if you look at the guarantees, they are horrible. That growth rate takes over thirty years to break even. Just put it in a bank at 2% if you want safe, guaranteed growth.

Concentration Risk

Insurance agents will also testify that it’s a great way to diversify risk. But let me ask you this: is having hundreds of thousands of dollars at one company diversified?

No! Anyone who tells you to reduce your concentration in hundreds of the best businesses in the world to put it into one of these companies is fooling you! And if they truly believe that they are helping you diversify, they are not only fooling you, they are fooling themselves.

Putting that much of your nest egg with one company is a classic concentration risk. Slap the word “guaranteed” on it a couple of times, and people think it’s somehow safer. But these guarantees are only as good as the claims payability of the insurance company.

Think of it this way. When a company issues a bond, they guarantee that they will pay that interest and return your original amount at the end of the term. Does that mean the money is guaranteed? Kind of. Unless the company goes under.

In our example, the financial representative tells the investor that it is a good idea and safe to have over $300,000 in one company. If I came to you and told you to purchase $300,000 worth of bonds from one company, would you feel diversified? Do you think your money is safe? Would any fiduciary financial planner recommend that much concentration? No, no, and no.

Cash value isn’t safe. It’s risky.

Cash Value Tax Benefits are Oversold

The main benefit after the general use and growth of cash value is the tax benefits. Financial representatives love to talk about the tax benefits of cash-value life insurance, even though they aren’t licensed or allowed to give tax advice. As a federally licensed Enrolled Agent with the IRS and a Fiduciary Certified Financial Planner, let me set the record straight.

It is true that cash value grows tax-deferred and can be used tax-free. Let me clarify how that works.

Cash Value Tax-Free Use

There are two ways to get cash value out of the policy tax-free: Partial Surrenders and Policy Loans.

Partial Surrenders

You can partially surrender a portion of your policy. This means you reduce your death benefit and take back a portion of your cash value. Doing this within fifteen years creates serious tax consequences that we don’t have time to get into. But after that, if you surrender less than what you’ve paid in premium (your cost basis), you can get that tax-free. If you’ve paid $40,000 in premiums and are trying to surrender $10,000 worth of cash value, you will get that tax-free. You can’t put the money back in if you do this.

Policy Loans

You can also take out a loan against your policy. Loan distributions are never taxable. So, any loans you take are tax-free. You can then repay the loan at any point to “get the money back in the policy.”

Tax Problems

Here are the problems they don’t tell you about with cash value are significant.

If you partially surrender less than your cost basis, that is tax-free. But if you surrender more than your cost basis, it is taxed at your highest marginal income tax bracket.

If you fully surrender a policy and it is less than your cost basis, you lose all that money, and you can’t claim any losses. If you fully surrender the policy and it is more than your cost basis, all the growth is fully taxable at your highest marginal income tax rate.

Taking a policy loan is tax-free. But if you take too much and loans and can’t pay them back, it may force the policy to surrender and, once again, you will pay taxes on the growth at your highest marginal tax rate.

Consider this. You’ve paid $120,000 in premium and have $350,000 in cash value at 65. You hit a bear market at take $200,000 out in policy loans. You pay $50,000 back before hitting another bear market. Now, you take out the maximum $180,000 allowed, reducing you to $20,000 in cash value. You now have a $330,000 policy loan. Rate change. The policy can no longer pay the interest. Now, you must pay the interest on the loan, pulling extra money out of your IRA at your highest marginal tax rate to pay this interest. And you must. Because if you don’t, the policy will surrender and $110,000 of growth will all be credited to you one year at your highest marginal income tax rate. Did your insurance agent cover this scenario when they were touting retirement benefits?

Alternatives

Here are two alternatives: Roth IRAs and Brokerage Accounts.

Roth IRAs let you “surrender” your cost basis without taxes or penalties as well, all while getting the far superior returns of equities on the growth you leave in there. So, if your plan is to do partial surrenders in the future, do a Roth.

If you want access to growth, not just contributions, then a brokerage account is a great choice. Yes, you will pay taxes on the dividends each year, but that is at the lower capital gains rate, which may be as low as 0%. When you sell in the future, you will also pay taxes on the growth at this lower capital gains rate. (If you and your spouse make about $125,000 or less in 2024, your capital gains rate will be 0%, allowing for strategies of tax gain harvesting.) And if you sell at a loss, at least you get to claim those losses against other income according to the rules (unlike cash value losses).

If you’re a high-income earner and don’t want to pay capital gains taxes, you can take out a margin loan against your assets. Loans are tax-free, so you, too, can access tax-free loans if that’s what you want to do. You can typically only borrow 50%, but 50% of a much larger amount. Would you rather have loan access to 90% of $75,000 in cash value or 50% of $340,000 in a brokerage account?

Goal: Highest After-Tax Earnings

At the end of the day, we don’t want to pay the least amount of taxes. We want the most amount of money after taxes. So yes, cash value may be more tax efficient. But its growth is so inefficient that it’s still a bad investment. You may pay more taxes on a brokerage account than on cash value. But you will have far more money after paying those taxes than in tax-advantaged cash value.

Don’t try and reduce taxes. Try and maximize money after taxes.

Other Issues

The growth, guarantees, and tax advantages of whole life insurance are the biggest selling points, and they are all garbage, especially compared to equity investing. But here are some more issues.

Whole Life is Inflexible

Here’s what I know from working with dozens of couples. Life happens. And not according to plan. You can change your 401(k) contributions percentage at any time, pause Roth IRA contributions, and choose when and how much to put into or take out of our brokerage account. But you can’t change your whole life insurance premium. Not really. Not without consequences.

Locking yourself into an inflexible payment plan is foolish, especially when you get so little in return. Flexibility and adaptability are not to be underestimated in a multi-decade financial plan.

Cash Value is Difficult and Costly to Use

Do you need cash out of your brokerage account or Roth IRA? Let your advisor know in a 30-second phone call, and you’ll have it in days. Need cash out of your whole life insurance policy? Fill out the form, send it in, and wait a few weeks for a check or ACH. Don’t forget to set up the loan repayment plan.

Oh, did they mention that you have to pay interest to use your own money? It makes sense to pay interest when you’re using other people’s money from a bank. But you must pay interest to use your own money in a policy. I’m sure they mentioned it, but I’m also sure they didn’t stress it.

Good insurance companies still pay dividends on your full policy, so agents will often point out that the interest you owe on the policy is nullified by the growth. Sure, you’re going to pay 8% in interest. But there is a 3% guaranteed growth (I doubt it), and they paid a 6% dividend last year for the fourth year in a row. So it evens out. But did they mention that, while they do still pay a dividend on balances with a loan against it, they drop that rate down to 1.5%?

You are paying money to use your own money. Would you rather pay a one-time 15% tax on the growth of your brokerage account withdrawals or an 8% annual loan on your entire policy loan? Think people!

Misleading Talking Points

Speaking of dividends, you may be misled on these. This varies greatly by company and agent, but I have repeatedly met with people who believed that the dividend they were getting was credited to their cash value, like a dividend in a brokerage account. They are not the same.

Let’s say you have $10,000 in a brokerage account, and it pays a 2.5% dividend. You are going to get 250 added to your $10,000 to get you $10,250. Let’s say you had $10,000 in cash value, and they pay a 6% dividend. I know a lot of people who have thought they would end up with $10,600. But that’s not how it works.

Insurance company dividends are first subjected to fees. Then, if you want to “reinvest” them, they are buying paid-up additional life insurance policies. So your $600 is buying as much insurance as a one-time $600 payment will buy (not much). Additional life insurance will come with additional cash value, maybe $100. Your 6% dividend turned into a 1% cash value growth. Congrats.

I’ve never once heard of an agent who stressed the taxability of surrenders before the policy was sold or seen a representative compare whole life and equities side-by-side. These are always done in isolation to mislead, intentionally or otherwise.

Website Example

Here is an example of a misleading statement directly from MassMutual. Read these two paragraphs regarding the taxability of using cash value.

Policy distributions (i.e., dividends, withdrawals, or partial surrenders) from a life insurance policy are first treated as a return of the cost basis. Only distributions that exceed the policy’s cost basis are subject to income tax. Distributions can be used for any reason without affecting the tax consequences — for example, to supplement retirement or education expenses. [Two sentences redacted for brevity.]

Example: In 2002, Al purchased a whole-life policy with a death benefit of $500,000 and $5,000 per year premiums. After 20 years, Al has paid total premiums of $100,000 (basis), and his policy has a cash value of $300,000. This year, Al wishes to withdraw $10,000 of cash value for education expenses. Since withdrawals from life insurance contracts reduce basis first and since $10,000 is less than Al’s $100,000 basis in his policy, this withdrawal will be tax-free to Al. However, assuming Al does not pay any more premiums, the next time he wishes to withdraw money from his policy, Al will only have a basis of $90,000. If Al completely withdraws his basis, his next withdrawal will be subject to income tax.

Did you catch it? The second sentence of the example states that Al’s total premiums paid would have tripled in 20 years. He’s paid $100,000 and premium and has $300,000 in cash value. Not on any planet would this be remotely true. According to a real illustration from MassMutual, cash value would be about 25% higher than premiums paid after 20 years, not 200% higher. This propaganda is printed right there on the website, subliminally telling unsuspecting victims that whole life insurance performs far better than it does. Because it’s an “example” to illustrate “taxes” and not growth, they can print it. It’s statements like these and many more that infuriate the fiduciaries among us.

Commission & Quota Conflicts of Interest

I’ve talked about this before, specifically in Episode 164, “What if Experts Disagree,” So I won’t belabor it here. But one of the main reasons it gets pushed so heavily is the because of the commissions and quota conflicts of interest.

Financial “advisors” who work for insurance-based firms have quotas or benchmarks of product sales they need to hit. If this is the case, are they recommending it because it’s best for you or because they are trying to win a trip to Tahiti?

Further, they are paid far more front on funding a whole life insurance policy than a Roth IRA or Brokerage. In our example of $3,000 per year of premium, the “advisor” would likely get paid $1,500, vs. funding an investment account at 1%, or $30. When the pay differential is that high ($1,500 vs. $30), do you think there is an incentive to recommend one over another?

Life Insurance Agent Rebuttals

I can already hear the insurance financial representatives crying out rebuttals of their own. Let’s examine some of the most common.

Advisors Make More on AUM

Since we ended with compensation, some are quick to point out that financial advisors make far more over the life of a client with an Assets Under Management (AUM) fee model than with a whole life policy. They accuse me of only recommending investments to load up on AUM and get paid more. They claim they are recommending it in the client’s best interest because, even though the advisor will be paid less over the relationship, it’s better for the client.

It’s true. If this 25-year-old, in our example, funded a Roth IRA with that money instead, the financial advisor would make more over time. Let’s say the advisor charges him 1% for a thirty-year relationship. On just that money, that advisor would have made about $31,000 more on AUM than on a whole-life policy. So yes, the advisor makes more money in the long run than selling whole life. Two counterpoints:

- To earn that money, the advisor would need to work with the client for 30 years. Those who sell products can sell and vanish; there is no need to keep delivering value.

- The advisor would have delivered deliver $280,000 more in account value than cash value. Would you pay a financial advisor $31,000 more over thirty years to get you $280,000 more in value after fees? I would. Ten out of ten times.

Stock Market Might Not Be That Good

Financial reps will accuse me of using pie-in-the-sky investment returns. “The market might be worse in the future!” they argue. Yes, and your non-guaranteed values may be worse in the future. It’s funny how you’ll claim things will get worse in the future for equities, but when it comes to whole life, they’ll tout the historical record of dividend payments as proof it will keep happening. So which is it? Can we base future returns on historical results or not?

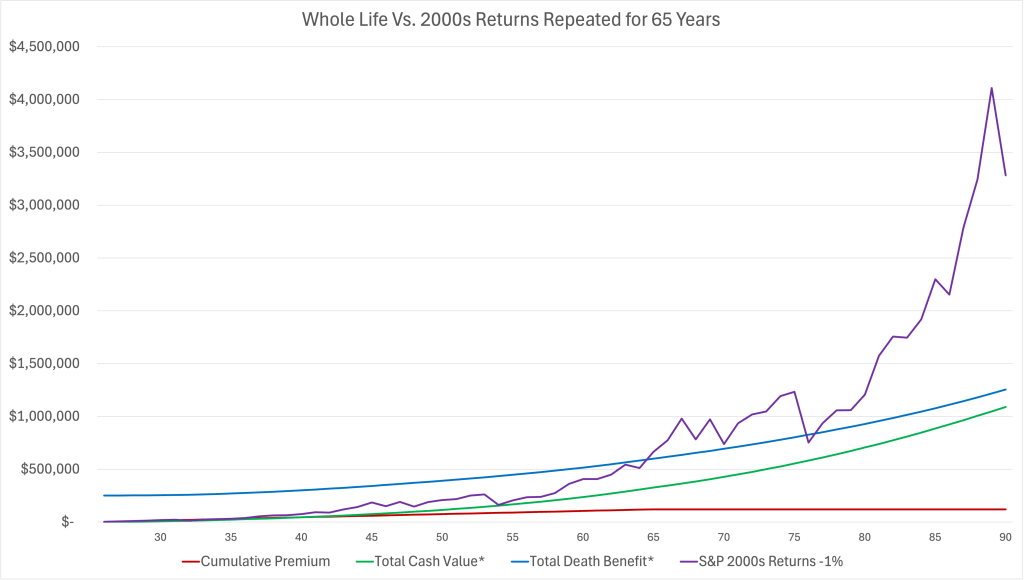

To put this to rest, let’s try an experiment. Instead of using the last 65 years of returns for historical reference, let’s take the returns of the 2000s and repeat them. We’ll use the S&P 500 returns from 2000 through 2023 (twenty-four years) and repeat them almost three times. This has several disadvantages for equities.

- It started right after the roaring 90s and right before the Dot Com bubble burst.

- It includes the Dot Come Bear Market and the Global Financial Crisis three times each. (Does anyone believe we will see this many of these catastrophes in a lifetime.) It also includes Covid and the Inflation Bear Markets twice each.

- It excludes the last iteration of 2017-2021, a collective 91% increase.

- We are still subtracting 1% annually.

- The average Rate of Return over this period now becomes 7.04%, rather than the 10.61% of reality.

So, what are the results? Surely, this would devastate equities, and cash-value life insurance will be redeemed. Right? Wrong.

It is significantly worse. You’d end up with $3.2 million instead of $12.2 million. You’d be worse off under these market conditions by $9 million. But you’re still $2 million better off than your whole life insurance death benefit.

Should you be so unlucky as to relive the 2000s three times in your lifetime, you’re still better off investing than using whole life. Millions of dollars better.

Sequence of Return Risk

“What about Sequence of Return Risk!?” they shout in desperation. This is the risk that, while returns may average out to a great number over time (say, 10%), the order of those returns matters. Bad returns late in accumulation or early can sink retirement and can wreck your overall investor returns.

Sequence of Return Risk is a real threat, one we deal with with our retiring clients. And whole life insurance is never part of the answer. The product takes so long to break even that it is no good at all to us for this risk. Don’t let someone scare you with this risk into buying a garbage “solution.”

Both/AND, not Either/Or

“But Freeman, I, too, am a Certified Financial PlannerTM Professional and a fiduciary. I take a comprehensive approach. It’s not an either/or proposition. It’s both/and. Of course, you want some of those excellent investment returns. But we must supplement them with the diversifying powers of whole life insurance.”

Wrong. For all the reasons stated above, primarily that it has garbage returns, you do not want to supplement with whole life. Why would you want any portion of your money taking 15 years to break even and going on to produce 3-5% long-term returns?

You Can’t Be 100% Equities in Retirement!

“You can’t allocate 100% to equities in retirement! Showing a 100% equity allocation until death is misleading!”

If you are millions of dollars ahead of your investment schedule, you sure could keep 100% in equities. You were happy with $300,000 in cash value heading into retirement. If you had $2.4 million in an account instead, so much that you could ride out a 60% temporary decline and still have three times as much as you did in cash value, then you certainly could stay 100% invested. (I’m not saying you should, just that you could.)

And if you’re illustrating the whole life until death without disturbing the growth, the client presumably has other money to live on. So they can live on that money, and I’ll illustrate equities until death, thank you very much.

Whole Life Covers Your Insurance Needs

“But whole life covers some of your insurance needs. You can spend less on term life insurance and have more money to invest.”

I knew you’d say that. We’re showing a $3,000 per year premium in this example. However, I subtracted $200 per year from our investing contribution. We’re only investing $2,800. That $200 should be more than enough to cover the $250,000 increase in our term life insurance to make up for the lost death benefit.

Buy term, invest the difference. It’s that simple, folks!

Own vs. Rent Your Insurance

“But term insurance goes away, and permanent is permanent. You should own, not rent, your life insurance, like you do a house.”

Except that a house has living and tangible value for your whole life (pardon the pun), and whole life insurance is a piece of paper. You need somewhere to live, so buying a home to eventually have no more housing payments makes sense. You don’t need the death benefit forever, especially when your living account values outpace your death benefits, even on an after-tax basis.

When you rent an Airbnb, it’s because you only need it for a limited time. Rent your life insurance because you only need it for a limited time.

Different for Older Folks

“Okay, so maybe twenty-five-olds don’t need it. But I work with baby boomers, and the need for permanent life insurance is real!”

It is different. I object less to a ten-year paid-up life insurance policy on a fifty-five-year-old than a forty-year policy on a twenty-five-year-old. But I still object. If we had time, I could show you the math. It’s still a garbage product with garbage returns—slightly less smelly returns, but garbage nonetheless.

If you are older, have a policy of your own, and are wondering if you should keep it, reach out. We can look at it together. Email us a Questions@RetireMentorship.com. If you’re paying thousands per year into this policy, doesn’t it make sense to ensure you should from an unbiased third party?

Life Insurance Has Other Benefits, Like LTCI

“Life insurance has other great benefits. I always use a Long-Term Care Insurance Rider on my policy to add another layer of benefits.”

Again, the rate of return on these policies is so atrocious that no other bells or whistles will overcome that. Would you rather have:

- $300,000 in cash value and an additional $300,000 to use for Long-Term Care?

- Have $2.4 million in an account end self-fund long-term care?

Clients Don’t have the Risk Tolerance

“Well, clients won’t stay invested. During a downturn, they will pull out. They don’t have the risk tolerance to invest in equities, and forcing them to is not fiduciary.”

That’s your job as the Financial Advisor. To get them invested and keep them invested. It’s your only job as an investment advisor. Risk tolerance questionnaires are stupid. Help them understand what investing really is and help them stay invested.

Clients Won’t Save Otherwise

“Well, when money gets tight, people always stop their retirement contributions. But they don’t stop paying their bills. Whole life becomes a forced savings plan. I have many clients who are glad they did it.”

First of all, you don’t know that they won’t save otherwise. If they came to you looking for the best options to save, there’s a good chance they would keep saving.

Even if they saved less without a whole life policy, it would likely be saved into a better product or strategy. They would get better results with less savings.

Lastly, that’s your job! Help clients save into the best strategies and keep them saving. That is what they are hiring you for!

Conclusion

I hope I haven’t been unclear. Whole Life is a terrible product and should be bought by basically no one.

The only people who it may make sense for are the ultra-rich who are buying it for deathbenefit and estate planning reasons, not for cash value. And in that case, whole life still is likely not the best permanent insurance for that. But you’d need to show me an exact case, and it still might not be my first choice.

If you have a permanent life insurance policy, you are age 50 or older, and you want to review it we me, set up a time a LaCrosseFinancialPlanning.com. If you’re under 50 and want to review your policy, find a good advisor at XYFinancialPlanning.com.

I hope this has been helpful. Check out our other content on YouTube and https://RetireMentorship.com.

We’ll see you next week. Cheers.

Want More? Become a RetireMember!

Get my book, 3D Retirement Income, for free, as well as access to live events, checklists and flowcharts, and wise counsel from one of the best minds in behavioral investing. Join today for free.

Need Help? Work with Me.

Schedule a Discovery Meeting with me through my Financial Planning firm, La Crosse Financial Planning. This no-cost, no-obligation conversation will determine what you are looking for and how we can help you retire successfully and stay successfully retired.

This article is educational only and is not intended to be investment, legal, or tax advice or recommendations, whether direct or incidental. Again, this is not investment advice. Consult your financial, tax, and legal professionals for specific advice related to your specific situation. Never take investment advice from someone who doesn’t know you and your specific situation. All opinions expressed in this article are those of the people expressing them. Any performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be directly invested in.