Section 1031 Exchange with my Rental Property

Can I Do a Section 1031 Exchange with my Rental Property? This flowchart will guide you through the eligibility factors.

Can I Do a Section 1031 Exchange with my Rental Property? This flowchart will guide you through the eligibility factors.

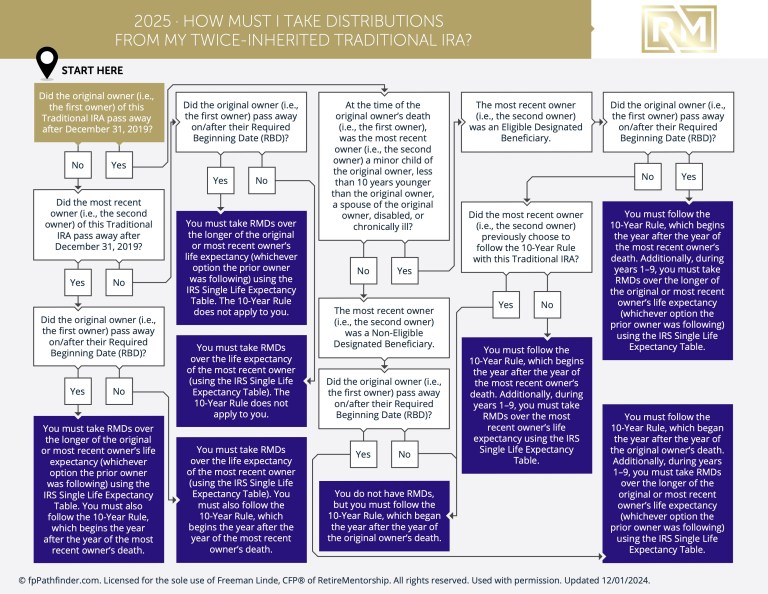

How Must I Take Distributions from my Twice-Inherited Traditional IRA? This flowchart will guide you through the eligibility factors.

How Must I Take Distributions from the Roth IRA I Inherited? This flowchart will guide you through the eligibility factors.

Interested in the TCJA Sunset? This flowchart will walk you through comparing the options.

Will The Distribution From My HSA Be Tax And Penalty Free? This flowchart will walk you through discovering the answer.

Will The Deductibility Of My Retirement Plan Contributions Be Impacted By The QBI Rules? This flowchart will walk you through discovering the answer.

Will My Social Security Benefits Be Reduced? This flowchart will walk you through discovering the answer.

Will My Roth IRA Conversion Be Penalty Free? This flowchart will walk you through discovering the answer.

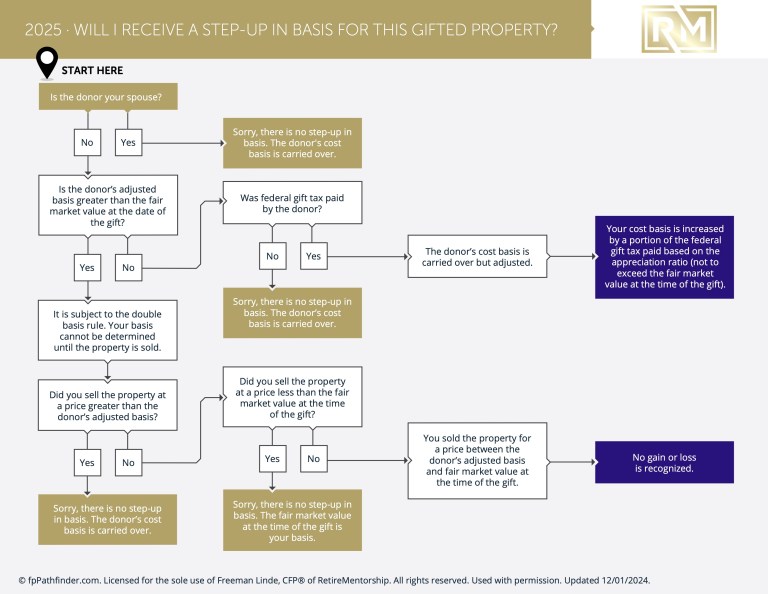

Will I Receive A Step Up In Basis For This Gifted Property? This flowchart will walk you through discovering the answer.

Will I Receive A Step Up In Basis For The Appreciated Property I Inherited? This flowchart will walk you through discovering the answer.

We’ll send it to you.

*Privacy Policy: We hate spam. We will not provide your information to anyone else or bother you.

Client Corner is a monthly article written by legendary financial advisor Nick Murray as part of his $350/yr Financial Advisor Newsletter. We are licensed to email those out each month, but we are unable to post them online. Check your email at the beginning of each month for the latest. You can request past Client Corner articles below.

Also available on Amazon (but not for free).

*Privacy Policy: We hate spam. We will not provide your information to anyone else or bother you.

Sign up for RetireMembership and gain access to the entire member-exclusive library of content and bonuses!

Pre-order a copy of Tax Saving Strategies from Amazon and get reimbursed (& unlock pre-order Bonus Content).

*with Reimbursement

Pre-order 10 copies of Tax Saving Strategies from Amazon and gain access to Pre-Order Bonus Content and the Ultimate Tax Strategy Bundle.

Pre-order a copy of Tax Saving Strategies from Amazon and get reimbursed (& unlock pre-order Bonus Content).

*with Reimbursement

Pre-order 10 copies of Tax Saving Strategies from Amazon and gain access to Pre-Order Bonus Content and the Ultimate Tax Strategy Bundle.